Managed Accounts

Free up time for the moments that matter.

All the security and flexibility of a HIN-based portfolio with the expertise of an experienced investment committee handling asset allocation, investment selection, and portfolio management when you're not available.

Our Portfolios

Professionally managed portfolios with results that speak for themselves.

Our investment committee manage four Australian Equities portfolios across Large Caps, Dividends Focus, All-Weather Stocks and Small Caps, as well as five multi-asset risk weighted model portfolios.

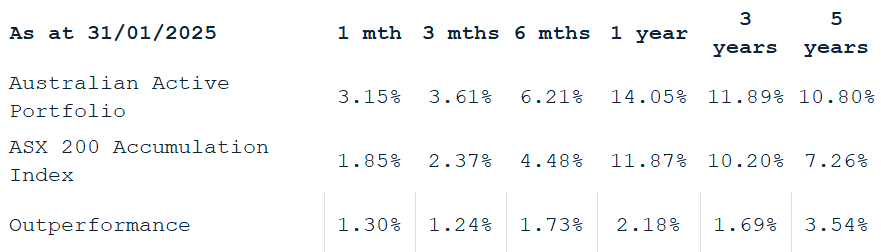

Australian Active Large Caps

Actively Managed Australian Share Portfolio

An actively-managed, long-only model portfolio focussed on Australian Large-Cap equities. The investment ideas incorporate Vested's views on global markets, domestic macro-economic outlook, bottom-up fundamental analysis and sector specific themes.

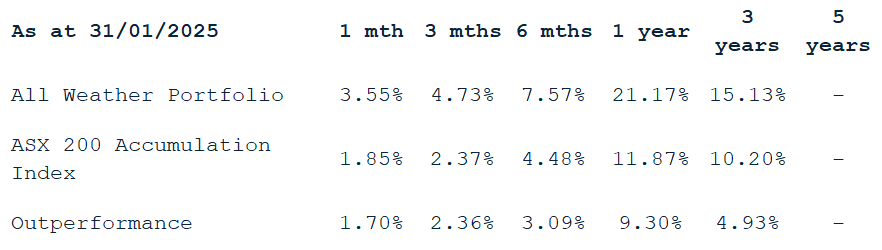

All-Weather Australian Equities

Vested-FN Arena All Weather Model Portfolio

The portfolio seeks to invest in companies with strong cash flow, robust balance sheets and excellent management. Companies must also have a high economic moat and favourable industry dynamics, which in turn provide lower earnings risk and less volatility over the longer term.

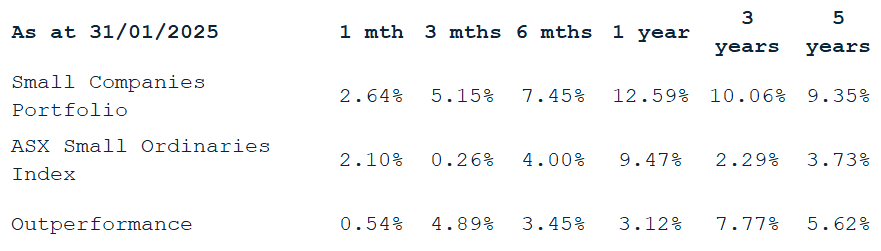

Australian Active Small Caps

Actively Managed Australian Small Share Portfolio

An actively managed, long-only model portfolio focussed on Australian small cap equities, with a focus on delivering stable growth and dividend yield. The investment ideas generated by the committee are the result of an in-depth analysis process involving meeting with management, financial modelling and bottom-up fundamental analysis.

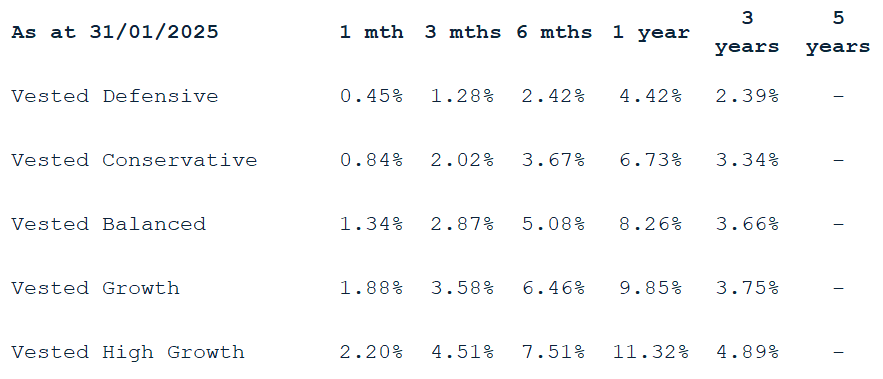

Multi-Asset Risk Weighted Portfolios

Five Actively Managed Portfolios, weighted in accordance with a risk profile across seven major asset classes.

Vested's Multi-Asset Strategy Model Portfolios are actively managed across 5 risk profiles investing across seven asset classes including global and domestic Equities, Property, Infrastructure and Fixed Income. Tactical Asset Allocation is used to manage risk while active investment selection aims to identify the best managers across Managed Funds, Exchange Traded Funds, Listed Investment Companies and Trusts and Real Estate Investment Trusts.

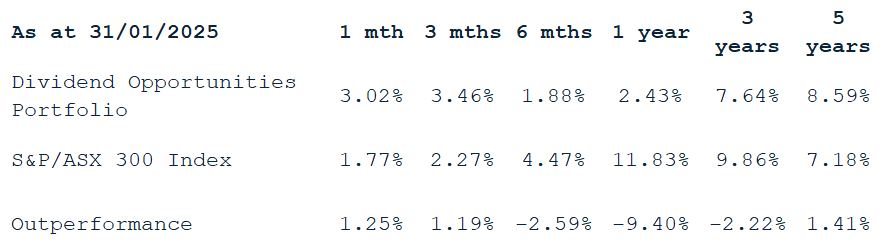

Australian Dividend Opportunities

A long only actively managed defensive portfolio focussed on Australian equities, that deliver stable dividend yield. The portfolio incorporates our global market macro-economic outlook with bottom up fundamental analysis and sector themes.

Portfolios are model portfolios, actual performance for individual investors may differ based on trade execution prices, entry and exit times, and rounding of holding sizes.

Performance is before expenses, fees, brokerage and taxes.

Past performance is not a reliable indicator of future performance.

Portfolio Reporting & Administration

Fast, accurate daily investment reporting for companies, trusts and individuals. Take the headache out of preparing for end-of-year reporting with our easy to navigate investment portal.

Simple & Efficient Changes

When our investment committee implement a change to the model, a record of advice is automatically sent detailing the effect on your portfolio. Utilising DocuSign, the approved changes are implemented and contract notes are distributed all on the same day.

Transparency & Ownership

Our client portal allows investors to track and/or approve every transaction on their account, while having visibility on all holdings right down to the finest detail. All ASX holdings are owned directly by the clients own HIN and settle via ASX contract notes.

Expert Management

Our committee members each have decades of experience and work collectively to identify top performing managers in each asset class. The team draw on support from external research house Banyan Tree investment group and Lonsec Group.